- Mar 20, 2025

Why Am I Leaving Revolut and the Money App for My Accounting?

- Daniele Catalanotto

- Numbers

Published in the Backstage Blog

How I did my accounting until now

Over the years, I've relied on the Money app on my Mac for accounting. It seamlessly connected to various bank accounts, automatically importing transactions. This was especially useful during tax season.

For a long time, I was a fan of Revolut because it offered instant exchange rates for payments in different currencies. For instance, my Swiss Revolut account handled dollar payments instantly, unlike my Swiss bank, Raiffeisen, which took days to finalize exchange rates. This made on-the-spot accounting easier.

Revolut double transaction extra work

But recently, Revolut started splitting payments and exchange rate fees into two separate transactions. This added extra work to my accounting, making it a pain in the ass. So, I decided to switch all my credit card activities back to Raiffeisen.

Money App stopped supporting Raiffeisen Bank in Switzerland

The Money app on Mac was another tool that worked well for me—until this ye

ar. It stopped working with my Raiffeisen account. As a result, I had to rethink my strategy for the 2024 taxes.

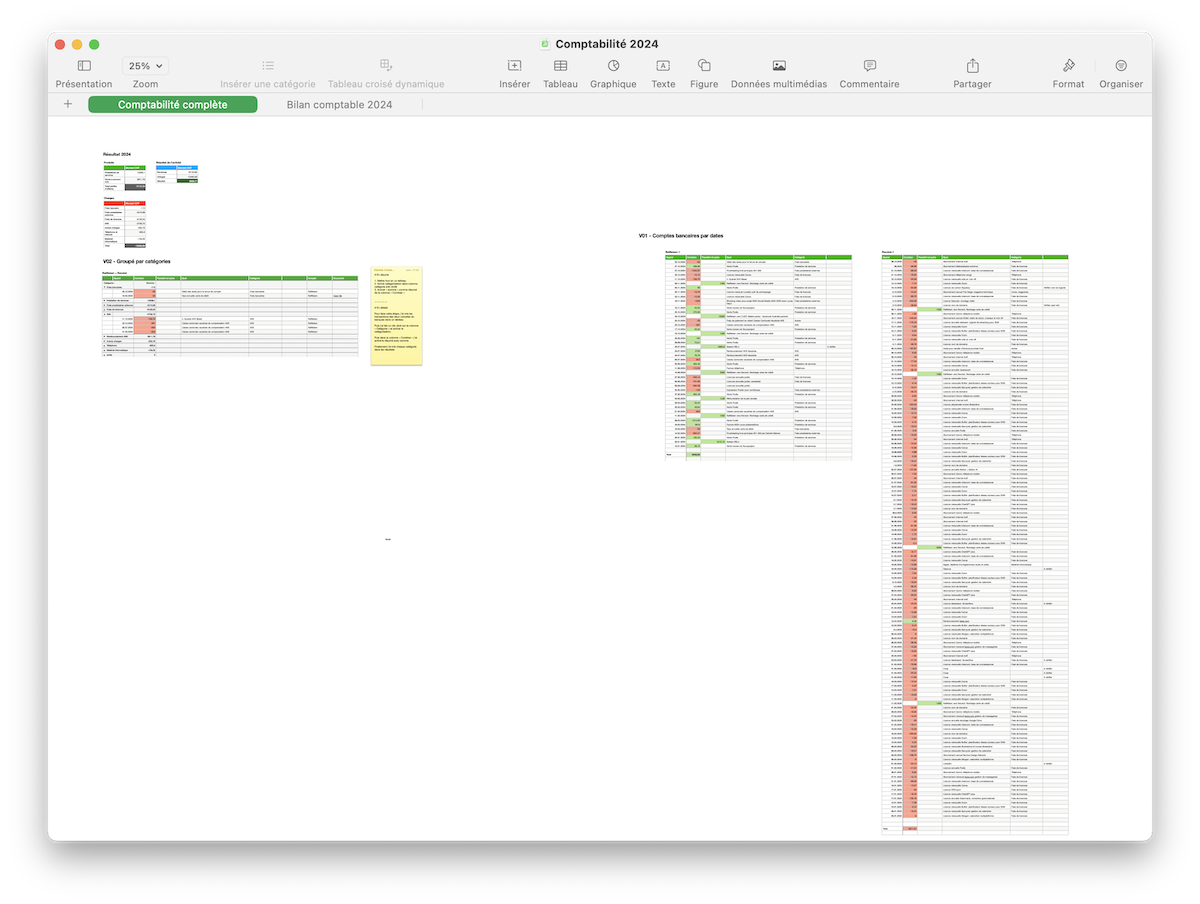

I opted to do my accounting manually using an Apple Numbers spreadsheet. Surprisingly, this method turned out to be quite fast, even though I had to import transactions from various bank accounts manually.

The Spreadsheet Solution

One of the perks of using Apple Numbers is its flexibility. I can tailor it exactly to my needs without being constrained by software designed for larger businesses.

However, there's a challenge: ensuring each transaction has a corresponding bill copy. Apple Numbers is just a spreadsheet; you can't directly attach files or link them easily.

For now, I've found a workaround by creating links from my iCloud files and adding them back into the spreadsheet. It's not perfect, it gets the job done.

It's not my first accounting migration

I'm no finance expert, but running a small business means annual accounting is a thing I have to do. My setup has evolved over time and is still far from perfect.

I've now decided to do my accounting using a spreadsheet software so that I don't have the surprise that my accounting app isn't updated anymore and bugs (just like what happened to me with Finances 2 a few years ago) or that suddenly it doesn't work anymore with my bank account (just like what happened to me with the Money App).

I imagine that having a dumb spreadsheet should avoid these problems as long as my small business stays small and I can keep my accounting setup simple as the Swiss law allows for it.

Written with AI help

This article is based on an audio recording I did while walking. It was then transcribed and adapted by Audiopen and I adapted it further by hand.

2 comments

I’ve migrated from various apps too, but in the end, I always find myself going back to my own handmade Google Sheets.

I’ve seen that some people use Notion to manage their finances and taxes. Maybe that could be a good option, too! I’m not sure if it would have any issues with attaching files and links, though.

Hey Leili!

Such a pleasure to see you also here in the comment section :)

Thanks for sharing some of your own journey, it's always re-assuring to see that others go through the same stuff :)

Indeed Notion is quite good for doing this type of stuff, I did it back in the days first like this. But at times it feels just overkill when a "good old and dumb" spreadsheet is good enough :P

Newsletter

Weekly Service Design Digest

Meet the creator

I worked with clients from all over the world to help them find innovative solutions to their problem. I've been blessed to be able to learn a lot.

Today I want to share these learnings back with the community. That's why I've built the Swiss Innovation Academy.